Daily Trending News in USA kicks off today with two major developments capturing national attention. The ongoing federal government shutdown, now one of the longest in US history, continues to create ripple effects across agencies and households. At the same time, new tariff threats by the US against China have rattled markets and heightened trade tensions. In this post we’ll break down what’s happening, why it matters, and what you should keep an eye on all in clear, digestible form. Not financial advice.

Government Shutdown Deepens and Impacts Spread

The government shutdown in the United States has entered its third week, and the effects are beginning to ripple more widely. CBS News+2The Guardian+2

Key Facts & Figures

| Metric | Description | Current Status |

|---|---|---|

| Days since shutdown began | Shutdown started Oct 1 2025. Wikipedia+1 | ~20 days |

| Federal employees affected | Approx. 900,000 furloughed + 2 million working without pay. Wikipedia | Large |

| Senate votes failed | 11th vote failed to advance funding measure. CBS News+1 | 0 progress |

| Courts’ funding status | Some courts may face operations halt. Wikipedia+1 | At risk |

Why It Matters

- Federal workers and contractors are facing income uncertainty; many households may feel pressure.

- Agencies like the Centers for Disease Control and Prevention (CDC) and National Institutes of Health (NIH) face partial disruptions, potentially delaying health research and public-health responses. Wikipedia+1

- Financial markets and consumer confidence can be affected when public services freeze or face uncertainty.

- Political credibility suffers: both major parties risk voter backlash if the shutdown persists.

What to Watch

- Will Congress pass a short-term continuing resolution or a comprehensive funding bill?

- Will federal employees receive back pay or face permanent layoffs?

- Secondary impacts: Social Security cost-of-living adjustments, national parks closures, federal court backlogs. (See: potential delay in Social Security COLA announcement.) New York Post

- How public sentiment shifts and whether either party shifts tone or strategy.

Trade Tensions Heat Up: US Threatens China with Massive Tariffs

In parallel to domestic turmoil, the US is facing growing external pressure in trade. Reuters

What Happened

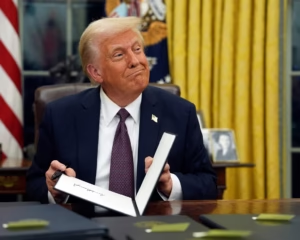

- The Donald Trump administration announced a “massive increase” in tariffs on Chinese imports after China imposed restrictions on rare-earth exports and added port fees on US ships. Reuters

- Markets responded swiftly: the S&P 500 fell ~1.2 %, the Nasdaq ~2.1 %, and the US dollar weakened. Reuters

Implications

- For US manufacturers and consumers: higher tariffs could mean increased costs for electronics, rare-earth-dependent goods, and supply-chain disruption.

- For investors: Uncertainty in trade policy often spurs volatility in equities and currency markets.

- Diplomatic/Geopolitical: A breakdown in trade talks could spill into other areas of US-China relations (tech, security, military).

- Timing: The move comes while domestic gridlock (shutdown) is already restraining economic policy agility.

What to Watch

- Will China retaliate further (additional export restrictions, currency shifts)?

- Will the US proceed with scheduled meetings or cancel/renegotiate?

- Impact on global supply chains: rare-earths, semiconductors, green-tech minerals.

- Will US firms begin adjusting sourcing/manufacturing away from China?

Interlinking Domestic & Global Dynamics

It’s critical to see that what happens at home often affects how the US acts abroad – and trade policy shifts can feed back into domestic economic stress. For example:

- A prolonged shutdown undermines US fiscal flexibility, which can weaken trade negotiation positions.

- Trade disruptions can hamper economic growth, which in turn limits federal revenue and could exacerbate budget standoffs.

- Public backlash to one issue (e.g., unpaid federal workers) can influence political willingness to act on another (e.g., trade tariffs).

Quick Table: Link Between Key Developments

| Issue | Domestic Impact | Global/Trade Impact |

|---|---|---|

| Government Shutdown | Worker furloughs, service disruption, political risk | Reduces US negotiating strength abroad |

| Trade/Tariff Move | Cost increases, market volatility, supply chain risk | Risk of escalation with China and allies |

| Combined Effect | Heightened uncertainty, investment slow-down | Global economic ripple-effects, slower growth |

What This Means for You (US Audience)

- If you’re a federal worker or contractor: keep abreast of funding votes, check HR updates for status of pay and benefits.

- If you work in manufacturing or sourcing: evaluate risk exposure to tariffs and anticipate cost increases or shifts in supply-chain geography.

- If you invest or trade: monitor market reaction, especially to US policy developments, and consider hedges for trade/volatility risk.

- If you’re a policy follower or engaged citizen: expect increased political heat; this may affect mid-term/local elections, regulatory policy, and public sentiment.

The shutdown began on October 1 2025 after Congress failed to pass the appropriations/CRO legislation needed to fund federal agencies. Wikipedia+1

No – Social Security payments are not directly tied to the annual appropriations process, but related announcements (such as the cost-of-living adjustment for 2026) could be delayed. New York Post

The administration indicated a “massive increase” but did not publish specific numbers at the time of announcement the uncertainty itself has generated market reaction.

Conclusion

Daily Trending News in USA is pointing to a challenging moment: internally, the nation’s fiscal machinery is stalled and employees are facing hardship; externally, the US is entering a more confrontational trade stance with China that could have broad ripple-effects. For US audiences, whether you’re a worker, consumer, business owner or investor, staying informed and preparing for uncertainty is wise. While neither situation is locked in permanently, the convergence of budgetary paralysis and trade escalation warrants close attention. As always, Not financial advice.