Introduction

Swing trading offers an attractive balance for traders who don’t want the intensity of day trading but still desire quicker results than long-term investing. Its importance lies in its flexibility, allowing traders to capitalize on market trends and reversals over a few days or weeks. This article will guide you through the best strategy for swing trading, emphasizing discipline, risk management, and tools for analyzing the market effectively.

Basics of Swing Trading

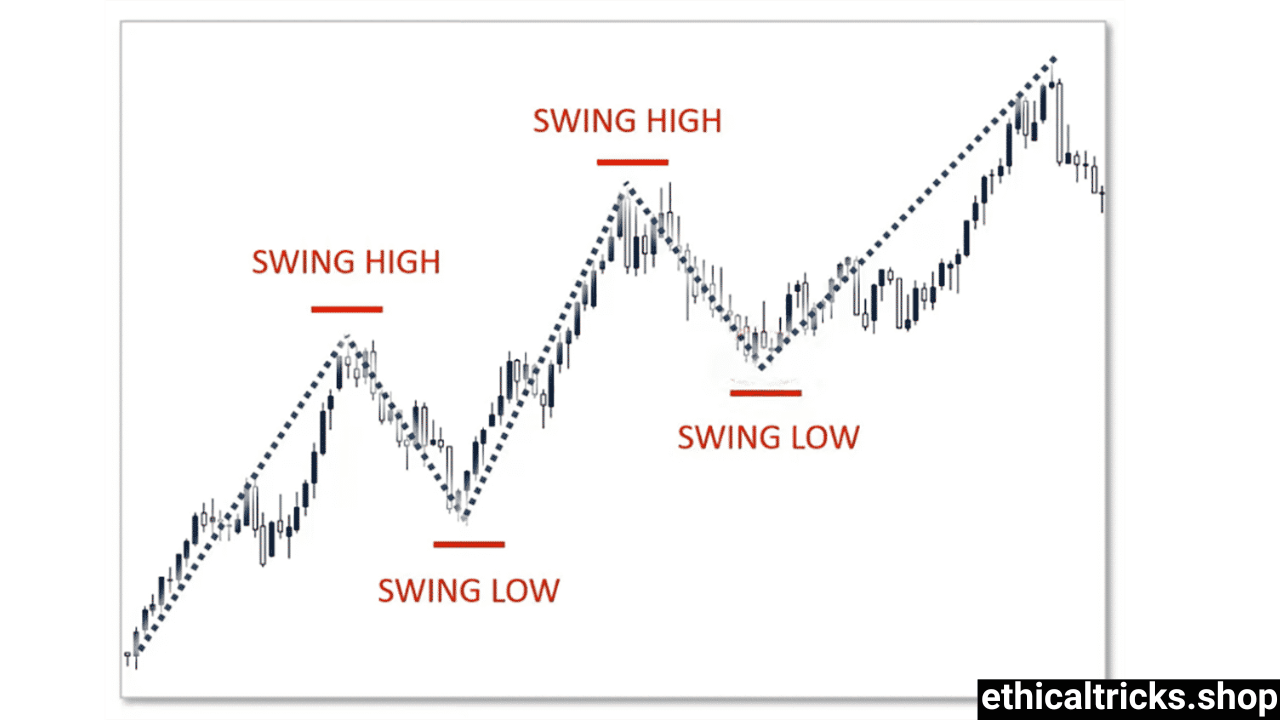

Swing trading revolves around identifying price movements in stocks, forex, or other markets. Traders use charts, patterns, and technical indicators to determine entry and exit points. The goal is to ride the “swing” in price, whether it’s upward or downward, before the trend reverses.

Some common tools for swing trading include:

- Moving Averages: Helps identify trends and potential reversals.

- Relative Strength Index (RSI): Indicates whether an asset is overbought or oversold.

- Candlestick Patterns: Visualize potential price reversals or continuations.

- Support and Resistance Levels: Guide traders on where to enter or exit trades.

Swing trading is suitable for stocks, forex, and commodities, as these markets frequently experience price swings due to news, earnings reports, or geopolitical events.

Importance of Risk Management

Effective risk management is crucial for successful swing trading. Without it, even a well-planned strategy can fail due to unpredictable market movements.

Here are essential risk management techniques for swing traders:

- Set a Stop-Loss: A stop-loss protects you from significant losses if the trade goes against you.

- Position Sizing: Never risk more than 1-2% of your total trading capital on a single trade.

- Diversify Trades: Avoid putting all your capital into one asset or market.

By managing risk, you ensure that a few losses don’t wipe out your account, allowing you to stay in the game for the long term.

Developing the Best Strategy for Swing Trading

A successful swing trading strategy combines technical analysis, market research, and discipline. Here’s how to develop a winning approach:

1. Identify the Trend

Start by identifying whether the market is trending up, down, or sideways. Use tools like moving averages, trendlines, and RSI to confirm the direction.

2. Find Entry and Exit Points

Look for patterns such as head and shoulders, double tops, or flag formations. Combine these with indicators like RSI or MACD to time your trades accurately.

3. Set Targets and Stop-Losses

Define your profit target and stop-loss level before entering a trade. For instance, aim for a risk-to-reward ratio of at least 1:2 to maximize returns.

4. Use Fundamental Analysis

While swing trading is primarily technical, don’t ignore fundamental factors such as earnings reports or economic data that can influence price movements.

5. Backtest Your Strategy

Test your strategy on historical data to ensure it’s effective. This step helps you identify weaknesses and refine your approach before trading live.

Common Mistakes to Avoid

Even the best strategy for swing trading can fail if you fall into these common traps:

- Overtrading: Placing too many trades increases transaction costs and emotional stress.

- Ignoring the Trend: Fighting the market trend often leads to losses.

- Emotional Trading: Making decisions based on fear or greed rather than analysis can harm your portfolio.

- Skipping Risk Management: Not using stop-losses or risking too much capital on one trade can lead to significant losses.

Avoiding these mistakes can greatly improve your chances of success as a swing trader.

Importance of Discipline and Consistency

Discipline is the backbone of successful swing trading. Following your plan and avoiding impulsive decisions are key to long-term profitability. Consistency in applying your strategy ensures that you can evaluate its effectiveness over time.

Here are some tips to stay disciplined:

- Maintain a trading journal to track your performance.

- Take regular breaks to avoid burnout.

- Focus on quality trades rather than quantity.

Consistency doesn’t mean sticking to a failing strategy. Instead, adapt to market conditions while staying true to your core principles.

Conclusion

The best strategy for swing trading involves a combination of technical analysis, risk management, and emotional discipline. By identifying trends, setting realistic targets, and avoiding common mistakes, traders can improve their chances of success. Remember, swing trading is a skill that takes time to master, so be patient and stick to your plan.

For beginners, start small and gradually build your confidence. With practice and the right approach, swing trading can become a profitable and rewarding venture.

To enhance your trading skills, explore our Beginner’s Guide to Trading Strategies and stay updated with the latest market insights on Investopedia’s trading section.